In Italy, around 1.4 million people (over 2% of the population) hold cryptocurrencies. The adoption index sees an important improvement (from 79th place to 51st place) even though the differences in usage between men and women are not so evident (57% vs. 43%). The majority of cryptocurrency users (44%) belong to the 28-38 age group. Moreover, 60% of Italian crypto users have at least a university degree.

The use of cryptocurrencies in Italy is definitely growing. The global adoption index published periodically by the company Chainalysis sees the ‘Belpaese’ climb several positions compared to 2021, moving from 79th place to 51st out of a sample of 146 nations (not all the nations of the world have processed the data necessary to draw up the index).

A truly important improvement that is reflected in the overall index compiled by the American blockchain analysis company, which went from 0.03 to 0.24, where 0 is the minimum and 1 represents the maximum, thanks to the change in the calculation methodology that now includes decentralised finance (DeFi) in the index.

It follows that decentralised finance in Italy is developing strongly, and this is a result that emerges objectively from the change in the calculation used to elaborate the index, which has produced a truly important improvement in Italy’s position.

According to data provided by ‘triple-a.io‘, an estimated 1.33 million people, 2.26% of the total Italian population, currently own cryptocurrency.

Considering that cryptocurrencies are still at an early stage, various studies and statistics show that Italy is gradually moving towards the mass adoption of cryptocurrencies and blockchain. From individual ownership to companies that have decided to buy crypto, Bitcoin represents the most widely held underlying asset in Italy followed by Ethereum.

Ripple, Litecoin and Bitcoin Cash, which were the main cryptocurrencies in the recent past, are losing market share to be replaced by Polygon Matic, Dogecoin, Cardano, Solana, Polkadot and others.

Among the interesting facts to highlight about the demographics of cryptocurrency ownership in Italy, again according to ‘triple-a.io‘, as of July 2022, it is estimated that 57% of cryptocurrency users are male, compared to 43% female. The majority of cryptocurrency users (44%) belong to the 28-38 age group. Furthermore, 60% of Italian crypto users have at least a university degree. Finally, a large group of Italian crypto users, about 80%, reported an annual income of EUR 10,000 to EUR 70,000.

The gap between male and female holders of digital money is not too pronounced and considering that finance and everything to do with numbers sees the male universe dominate, it is really interesting how much women are interested in the subject and have enough knowledge to drive them to invest. In fact, the first commandment in this sector concerns education and is based on the consideration that only an adequate knowledge of the phenomenon makes it possible to govern it.

In terms of volumes, the data provided by Chainalisys on the Italian market show that between 2021 and 2022 more than $80bn (at historical market values) was transacted between centralised exchanges and DeFi platforms, with a growth of 22% compared to the 2020-2021 period. The same study shows that Italy occupies fifth place in this ranking within the European Union (and sixth if the United Kingdom is also considered).

About the Italian cities where there are more Bitcoin ATMs, the 2020 data provided by ‘statista.com‘ saw Milan, Rome and Bologna with the largest installations, while about the cities where payment in cryptocurrency is permitted, the gap between the North and the South is undoubtedly evident, with Milan, Genoa, Florence and Bologna being pro-crypto, again according to data provided by ‘statista.com‘.

But the real surprise is represented by Rome. In fact, Fast Private Jet, a company specialising in private jet hire, has drawn up a ranking of the most crypto-friendly cities in Europe, from which it turns out that Rome is becoming an important crypto hub, in fact it ranks fourth in Europe (after Ljubljana, Prague and Madrid) among the cities where it is possible to spend cryptocurrencies easily.

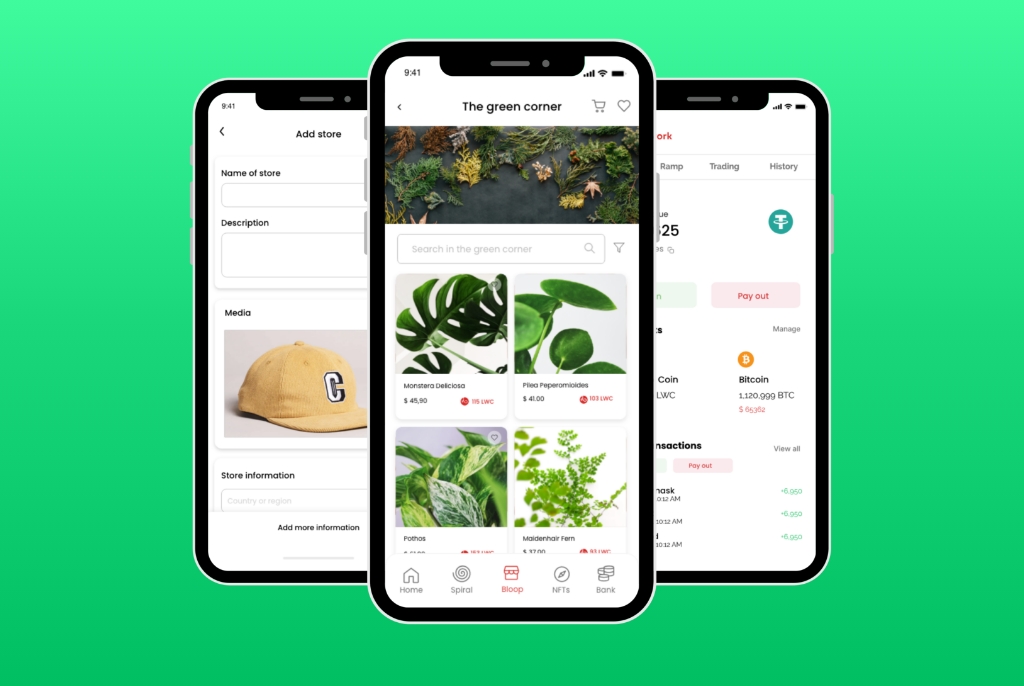

In the European context, operators such as N26 through its collaboration with BitPanda, Revolut and BBVA have represented the entry of traditional finance into the crypto sector. In Italy, intermediaries such as Banca Generali, Hype (Banca Sella) and Tinaba (Banca Profilo) offer their customers the possibility of purchasing crypto-assets through the promotion of services offered by some Italian exchanges.

Given such a vast phenomenon, the need for regulation is becoming more and more pressing, and in this sense, the Italian legislator felt the urgency to be the first among EU countries to anticipate the transposition of part of the regulations on cryptocurrencies contained in the Fifth Anti-Money Laundering Directive (2018/843).

Moreover, as a corollary to the transposition of the Fifth Directive, the regulation of moneychangers provided for in Legislative Decree No. 141/2010 has been extended to service providers relating to the use of virtual currency and virtual wallet services, who are required from 17 July 2022 to be registered in a special Section of the Register of Moneychangers kept by the OAM and to communicate to the latter the information relating to the transactions carried out.

With a view to investing in technology, research and innovation and promoting blockchain projects, the Italian government is sensitive and has programmed EUR 46 million to be addressed to the economic support on development of businesses that operate in Blockchain.

Regarding the taxation of income from buying and selling crypto assets, capital gains will have to be added algebraically to the relevant capital losses and, as a result of the new legislation, will only be taxed at 26% (with the same criteria adopted for investment funds, deposits, assimilating them to the taxation for capital gains originated by foreign currencies) if they exceed EUR 2,000 in the tax period.