Welcome AUSDT

Now listed!

Welcome AUSDT

Now Listed!

Stability Meets Innovation:

A New Era of Digital Finance

Discover the power of AUSDT, a stablecoin built on the ALLTRA protocol, now seamlessly integrated into the Linework ecosystem. Whether you’re trading, transferring, or shopping, AUSDT brings stability and flexibility to your digital assets.

AUSDT Listed on the Linework Ecosystem

We’re excited to announce that AUSDT (USDT) is listed in the Linework ecosystem, expanding the possibilities for stable, reliable, and transparent transactions.

WHAT IS AUSDT?

The AUSDT (USDT) backed token represent a stablecoin based on the ACR-20 and compatible with SmartChain. AUSDT is an ALLTRA stablecoin issued by Niisitapi Sovreign Bank also compatible with Binance SmartChain (BSC).

- AUSDT is built using the OZZ Metals LTD (ALLTRA) blockhain

- These tokens are linked to stable fiat currencies, ensuring their value stable and Metamask BSC Chain compatible.

- AUSDT provide new financial opportunities for business and loan operations.

- The tokens are decentralized and community-driven, with no central authority as well.

- AUSDT (USDT) pave the way for decentralized applications (dApps) and ATM transaction.

INTRODUCTION TO

ACR-20 TOKENS

ACR20 tokens are a new type of digital asset ALLTRA.Global blockchain, made possible by the Alltra portocol. ACR For Alltra Contract Readable which run on EVM (Ethereum Virtual Machine). You can deploy them directly or through a decentralized process, making them both stable and secure.

WHAT ARE ACR-20 TOKENS?

ACR-20 tokens are fungible digital assets (meaning each token is interchangeable) created using the Alltra Blockchain thru any wqllet provider. This link ensures that every ACR-20 token is backed by USD and USDT value, making them decentralized and trust-minimized.

In simple terms, ACR-20 tokens bring the power of tokenization to the Alltra network, allowing users to create and manage digital assets with the same security and simplicity as Ethereum itself.

ACR-20 Tokens:

The Future of CRYPTO-Based Digital APPLICATION

Discover How ACR-20 Tokens Work and Why They’re Revolutionizing the Blockchain Space

HOW DO ARC-20

TOKENS WORK?

ARC-20 tokens use Satoshi as the base unit, with each token being tied to a specific satoshi. This setup allows ARC-20 tokens to be transferred, split, or combined just like Bitcoin itself.

Unlike Ethereum-based tokens, which operate on a complex set of smart contracts, ARC-20 tokens work directly within Bitcoin’s simple UTXO model.

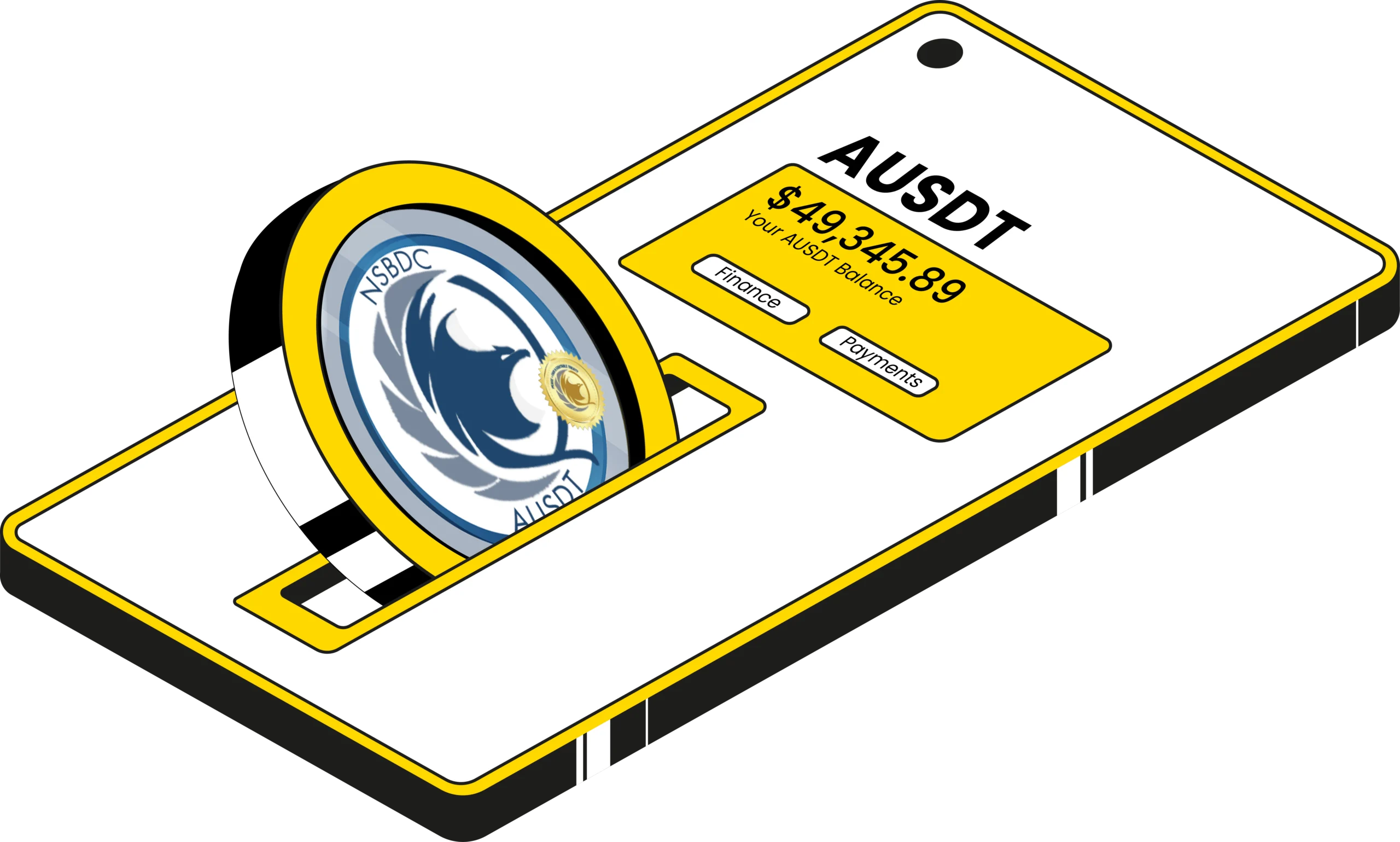

HOW TO USE IT IN LINEWORK dAPP?

Linework has integrated AUSDT as a main stablecoin in-app. The AUSDT coin is based on the Alltra Blockchain, backed by USDT and fiat currencies, cash and insurances like usual USDT.

In the Linework app the AUSDT can be:

- Imported (PayIn procedure)

- Exported (PayOut) procedure.

- Transferred internally between 2 users instantly.

- PayIn fees, PayOut fees.

- Paying on Marketplace.

- Making Security Deposit, Insurance and shipping fees.

- Advertising and Sponsorship ads/Stores.

- Swap the coin between your current assets.

- Connected to your external wallet provide.

- Interacting with ALLTRA Smartchain.