Considered as one of the four asian tigers at dawn of XXI century, with Hong Kong, South Korea and Taiwan, more than 20 years later we can still hear Singapore roaring when talking about adoption and use of cryptocurrencies.

8.000 miles and 6 hours of time zone away from us, Singapore has a say in the matter in application of new technologies and demolition of socio-cultural and economic barriers. Since Singapore became independent, separating from Malaysia in 1965, the economy of the asian city-state has continued growing until today, when the contemporary Singapore places as 5th worldwide in the ranking, drafted by the International Monetary Fund (IMF) that estimates national GDP per capita of 2023, passing over Qatar and United States of America and positioning itself behind Luxembourg, Ireland, Norway and Switzerland.

And as for the adoption and use of cryptocurrencies, the story remains the same: while global cryptocurrency ownership rates average around 4.2% in 2022, Singapore shows significantly higher adoption rates, equal to 11.05%, as reported by a survey by Cointelegraph, one of the most important online portal for news about the cryptocurrency industry. This is largely attributed to the technological proficiency of the populations and the pro-cryptocurrency stance adopted by both Southeast Asian countries.

Not even the half of it! The leadership is also confirmed when it came to adopting a fair (and balanced) regulatory and legal framework for the cryptocurrency sector. Already adopted in 2020, the Payment Services Act (PSA) is the overarching regulatory framework for traditional and cryptocurrency exchanges. This act brought together all payment-related services under a single legislation and detailed licensing and anti-money laundering compliance requirements for cryptocurrency industry players.

Under the PSA, digital currencies are referred to as Digital Payment Tokens (DPT), with Bitcoin (BTC) and Ether (ETH) recognized as cryptocurrencies by the MAS, national financial regulatory body. This makes cryptocurrencies approved legal assets in Singapore, allowing them to be treated similarly to other asset classes. The act also requires any person or business performing DPT-related services to obtain a Standard or Principal Payment Institution License, which is required by a Singapore-registered company. The MAS also brought DPT’s public offerings or issuances under the Securities and Futures Act (SFA) in May 2020, believing that approved tokens are treated as real financial products. own.

In a territory of only 733 km², with a surface area almost equal to that of New York, an incredible power of innovation is concentrated, where the authorities and companies in the sector have wanted to focus on cryptocurrencies and regulate their use for a correct (and secure ) use by all.

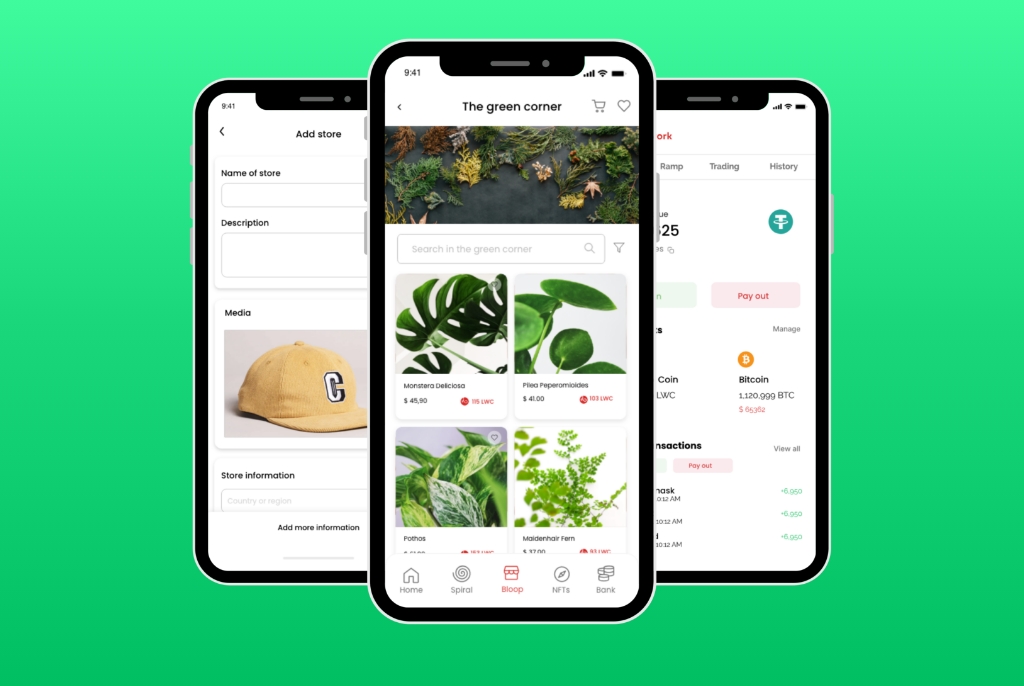

The first partner chosen by Linework for the listing of the Linework Coin (LWC) on the international markets was Bitmart, Centralized Exchange (CEX) with license to operate obtained in Singapore. A strategic choice to open up to a constantly evolving and expanding market, which looks to the future without fear and with a great desire to grab it.

As for Linework, the awareness of a different, new, innovative future without geographical and socio-political boundaries passes through the use and development of new tools that can give voice (and economic strength) to the other side of the world, all ‘another 80% who have the right to be able to build a secure future and have control over their assets, as well as complete freedom of expression, without censorship and without social stigmas.